A key GOP member of the New York delegation said Tuesday that GOP lawmakers are nowhere near a deal to help residents of high-income states lower their tax bills.

“We’re probably only on the 25 yard line. We’ve got about 75 more yards to go,” Rep. Nick LaLota (R-N.Y.) said. “We’ve had a lot of conversations, [and] a lot of ideas have been exchanged. But we’re very far from a specific deal.”

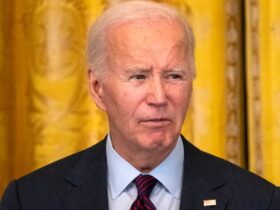

The debate over the federal deduction for state and local taxes, known as SALT, has emerged as a key sticking point as GOP leaders race to adopt President Trump’s ambitious domestic agenda in the coming months.

Trump’s 2017 tax reform law imposed a $10,000 ceiling on the SALT benefit and disproportionately hit taxpayers in higher-income states — which also tend to have higher local and state tax rates. The move sparked howls from lawmakers of both parties in those states, who warned that it would penalize middle-class families, not just the wealthier taxpayers it was intended to target.

LaLota is one of the critics who’s battling within his own party to provide help to his eastern Long Island constituents. His challenge, he said, is getting GOP leaders and fellow Republicans on the Ways and Means Committee to “understand that SALT is a matter of fairness.”

“It’s not a subsidy. In fact, New York sends way more to the federal government than we get back, in terms of tax dollars,” he said. “And SALT — a high SALT cap — is one of the ways we make that inequity a little more fair.”

Democrats have long contended that Trump and Republicans applied the SALT cap in 2017, at least in part, to punish Trump’s political enemies in wealthier blue states like New York, California, Virginia and Illinois.

But it also served to increase revenues to the Treasury Department and helped to reduce the cost of the tax package — the same budget consideration GOP leaders are grappling with again as they seek ways to extend the 2017 tax cuts while minimizing the impact on deficit spending.

Amid that debate, some lawmakers have floated compromise proposals to apply new income thresholds to the current SALT cap, so that only higher incomes households — those earning more than $400,000, for example — are subject to the cap. But LaLota rejected that idea outright, saying the differences in regional incomes mean New Yorkers would still be treated unfairly.

“Just like the initial SALT cap, it unfairly punishes high-income blue states like mine,” he said. “Four-hundred thousand dollars may be rich in Missouri. It ain’t rich in Suffolk County. So I think that approach just exacerbates the anti-blue state approach that existed eight years ago.”

The sides are running out of time to reach a deal. The Ways and Means Committee is expected to consider the tax portion of Trump’s “big beautiful bill” next week.

Leave a Reply