Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it’s investigating the financials of Elon Musk’s pro-Trump PAC or producing our latest documentary, ‘The A Word’, which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

The Trump administration appears to be softening its rhetoric towards China after Washington and Beijing rapidly escalated a trade war in the past few weeks.

Donald Trump said this week they were working on a deal and tariffs would come down, while U.S. treasury secretary Scott Bessent said there was “an opportunity for a big deal here” as the countries prepare to start negotiations.

The U.S. has raised tariffs on Chinese goods to 145 per cent and threatened tariffs of up to 245 per cent, while China has lifted tariffs on U.S. goods to 125 in retaliation.

Despite the slight change in tone from the White House, China says it will not be bullied into a deal.

Here are some of the key reasons Beijing has less reason than the U.S. to back down first.

China can take the pain in ways the U.S. cannot

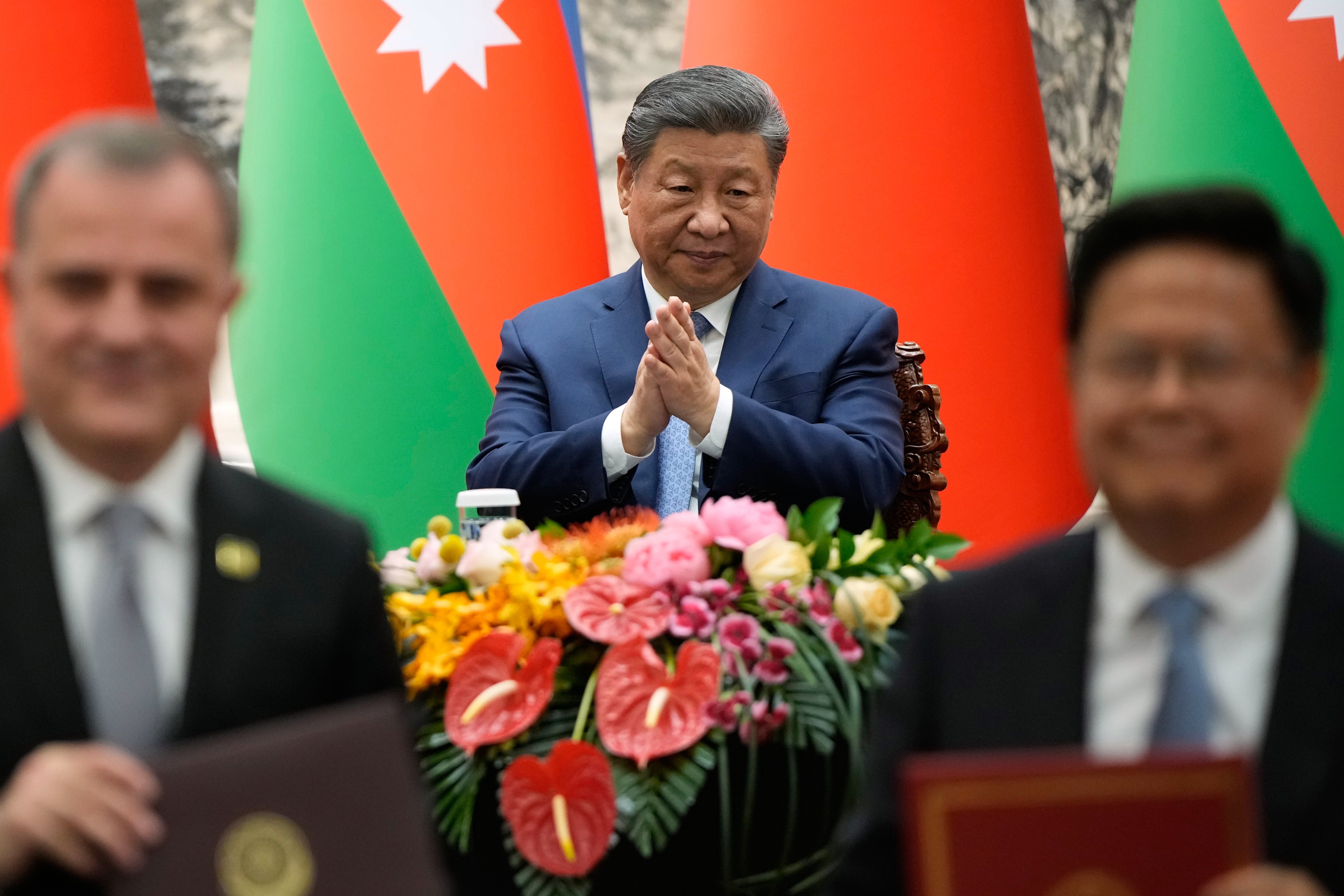

Not being a democracy works in China’s favour here. It means Chinese President Xi Jinping does not have to worry about public sentiment over economic turmoil as much as Trump does, so he can wear a higher economic pain in the short term to wait the U.S. out.

China’s economy grew by 5.4 per cent in the first quarter of 2025 compared to the same quarter last year, according to the most recent data from Beijing, while at the end of last year economic growth in the U.S. was less than half that, growing at an annual rate of 2.4 per cent.

That means that very broadly speaking, China’s economy has more capacity to take an economic shock such as higher tariffs than the U.S. economy does, before it starts to get into real trouble.

Xi can also play a longer game, as he doesn’t have mid-term elections in 2026, as Trump does, that could undermine his leadership. Even beyond that, the US faces a new administration at the end of Trump’s current term, which could bring a whole new set of economic and trade policies and reignite trade turmoil.

Trade war gives China more opportunities elsewhere

All this turmoil and instability from the U.S. has given Xi the opportunity to present China as the stable, sensible alternative in global trade relationships.

Xi has long worked to strengthen China’s soft power influence through its belt and road program through the Global South, but relationships with Western countries have not always been smooth – its trade war with Australia completely ended after a long wind-down late last year.

And the Chinese government has been at pains since the trade war began to emphasize it supports a multilateral trading system and opposes “economic bullying”.

Xi spent last week visiting Malaysia, Cambodia and Vietnam – all countries expected to be hit hard if the full reciprocal tariffs are introduced – to discuss strengthening trade ties.

China already relies less on the U.S.

Since its last trade war with the U.S. in Trump’s first term, Xi has expanded trade relations with other countries to reduce its reliance on American goods.

Soy has been one of America’s largest agricultural exports to China, but Beijing has been working to increase its own production of soy and increase its imports from Brazil to reduce reliance on the U.S. – in fact in between March 2024 and February 2025, Brazil was the top exporter of soy to China, according to to the Observatory of Economic Complexity.

Brazil’s soy exports to China were worth $35.6 billion in 2024, compared to U.S. exports which were worth roughly a third of that ($12.1 billion).

Soy is just one example, but Xi’s recent visit to South-East Asia shows the country is working to diversify even further.

China hold the global upper hand on critical minerals

Beijing also holds a major card: it is the world’s largest producer of critical minerals, which are vital components in the technology used to make everything from mobile phones to computers to batteries and fighter jets.

China mines more than half of the world’s rare earths, but importantly, it processes about 90 per cent of them. China knows that building the capacity to process these rare earths – which can be a dirty, toxic process – takes time, and it can bank on being the global supplier for some time yet.

That gives China significant power to control the global price of critical minerals, but it can also turn off the tap – which it did earlier this month, according to the New York Times, suspending exports on a wide variety of critical minerals to the US.

It means components essential to car manufacturers, semiconductor companies and military contractors will be difficult to get, and U.S. companies will want the Trump administration to reach a deal soon to regain access to those much-needed materials.

Leave a Reply