Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it’s investigating the financials of Elon Musk’s pro-Trump PAC or producing our latest documentary, ‘The A Word’, which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

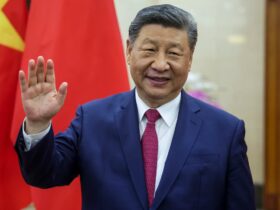

President Donald Trump said Wednesday he doesn’t want to raise taxes on the rich because he fears they’d leave the country.

When a reporter asked Trump if he would “support a millionaire tax,” the president said it would be “disruptive because a lot of millionaires would leave the country” thanks to modern transportation.

“You know, the old days, they left states,” Trump said from the Oval Office. “They’d go from one state to the other. Now, with transportation so quick and so easy, they leave countries.”

He added: “You lose a lot of money if you do that. And other countries that have done it have lost a lot of people. They lose their wealthy people. That would be bad because the wealthy people pay the tax.”

Many appealing countries that might attract wealthy Americans have taxes of their own that the new residents would have to pay, including several with substantially higher tax rates than the U.S. If millionaires maintain their U.S. citizenship and simply live and work abroad, they would still be obligated to pay U.S. taxes.

Trump’s comments mark a reversal from just weeks ago, when he told Senate Budget Committee Republicans and Majority Leader John Thune that he would be open to increasing taxes on the nation’s highest earners, Semafor reported.

White House officials were even weighing allowing a tax increase on rich Americans in exchange for cutting taxes on tips, Axios reported in late March.

Some Republicans have been considering raising the top tax rate for millionaires to about 39 percent to 40 percent, up from 37 percent, Bloomberg reported early this month.

The tax rate was 39.6 percent before Trump’s tax law in his first administration in 2017 slashed corporate taxes to 21 percent and otherwise mostly benefited the wealthy.

Renewing that law, which expires this year, along with new tax cuts is expected to add $4 trillion to the surging debt.

Some moderate Republicans argue that increases on high-income earners could reduce the national debt without hampering economic growth.

The Washington Post has reported that even members of Trump’s inner circle, including Vice President JDS Vance and Treasury Secretary Scott Bessent, have spoken in favor of raising taxes for those earning more than $1 million per year.

But so far the idea doesn’t appear to be gaining traction, and Trump no longer seems to be on board.

Trump has frequently hinted that tariffs could potentially replace the income tax, even though economists warn that tariffs raise far less revenue and fall far harder on lower-income households who pay the extra costs passed on by American importers hit with tariffs on foreign goods.

Leave a Reply